The Main Principles Of Medicaid

Wiki Article

Our Insurance Statements

Table of ContentsThe 8-Second Trick For Cheap Car InsuranceNot known Details About Cheap Car Insurance The 7-Minute Rule for Health InsuranceThings about Life Insurance

You Might Want Disability Insurance Too "In contrast to what many individuals assume, their home or vehicle is not their greatest asset. Rather, it is their ability to earn an earnings. Yet, many professionals do not insure the chance of a special needs," claimed John Barnes, CFP and also proprietor of My Family members Life Insurance, in an e-mail to The Equilibrium.

The details below concentrates on life insurance policy sold to individuals. Term Term Insurance is the most basic form of life insurance. It pays only if death happens throughout the term of the policy, which is generally from one to thirty years. Most term plans have no various other benefit stipulations. There are two fundamental types of term life insurance policy plans: degree term as well as decreasing term.

The expense per $1,000 of advantage boosts as the guaranteed person ages, and it clearly obtains really high when the guaranteed lives to 80 as well as beyond. The insurance coverage firm can bill a premium that boosts each year, however that would certainly make it really hard for the majority of people to manage life insurance policy at advanced ages.

Rumored Buzz on Life Insurance

Insurance coverage plans are developed on the concept that although we can not stop unfortunate events happening, we can safeguard ourselves financially versus them. There are a huge number of different insurance plan readily available on the market, as well as all insurance providers try to persuade us of the values of their particular product. So much so that it can be difficult to determine which insurance plan are actually required, as well as which ones we can genuinely live without.Researchers have actually found that if the key wage income earner were to die their family would only be able to cover their household costs for simply a few months; one in four family members would have problems covering their outgoings immediately. The majority of insurance firms recommend that you take out cover for around 10 times your annual earnings - life insurance.

You need to also factor in child care expenditures, and also future university costs if appropriate. There are 2 major sorts of life insurance coverage plan to pick from: entire life policies, and term life plans. Read Full Article You spend for whole life plans till you pass away, and also you pay for term life policies for a set amount of time determined when you get the plan.

Wellness Insurance, Health insurance policy is one more among the 4 primary kinds of insurance policy that experts advise. A recent study revealed that sixty two percent of personal insolvencies in the US in 2007 were as a direct outcome of health issue. A surprising seventy 8 percent of these filers had wellness insurance when their illness began.

Life Insurance Can Be Fun For Anyone

Premiums vary substantially according to your age, your existing state of wellness, and your way of life. Also if it is not a legal demand to take out automobile insurance where you live it is highly suggested that you have some kind of plan in area as you will certainly still have to presume financial duty in the case of a crash.In addition, your vehicle is typically one of your most useful possessions, and if it is harmed in a crash you might battle to spend for repair work, or for a substitute. You can additionally find yourself liable for injuries received by your passengers, or the chauffeur of an additional automobile, and also for damages caused to another lorry as an outcome of your oversight.

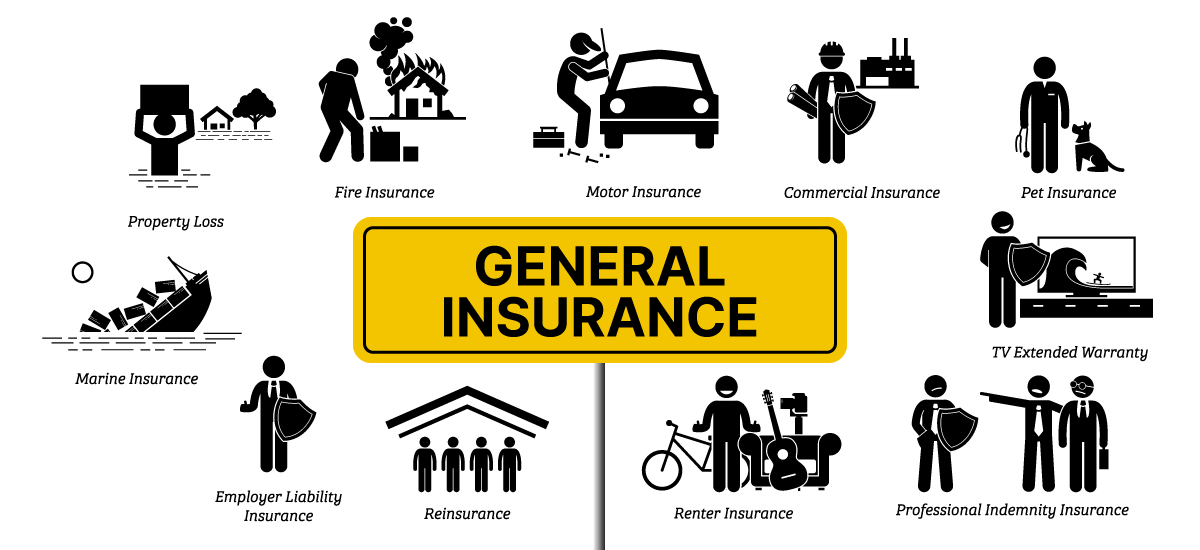

General insurance covers house, your travel, car, as well as health and wellness (non-life possessions) from fire, floods, mishaps, manufactured calamities, and also theft. Different kinds of basic insurance include electric motor insurance policy, health and wellness insurance coverage, travel insurance, and residence insurance policy. A general insurance coverage pays for the losses that are sustained by the insured during the period of the policy.

Continue reading to know more regarding them: As the residence is a beneficial property, it is necessary to secure your residence with a proper. House as well as family insurance coverage safeguard your house and also the items in it. A a fantastic read residence insurance plan essentially covers directory synthetic as well as natural circumstances that might result in damage or loss.

The Greatest Guide To Medicaid

It can be found in 2 kinds, third-party and detailed. When your automobile is in charge of an accident, third-party insurance cares for the harm caused to a third-party. You should take into account one fact that it does not cover any of your vehicle's problems. It is additionally vital to keep in mind that third-party electric motor insurance policy is required as per the Electric Motor Cars Act, 1988.

A a hospital stay expenditures up to the amount insured. When it involves medical insurance, one can choose a standalone health and wellness plan or a household floater plan that uses coverage for all family participants. Life insurance policy gives coverage for your life. If a circumstance occurs where the insurance policy holder has a premature fatality within the term of the policy, after that the candidate obtains the sum ensured by the insurance business.

Life insurance coverage is different from basic insurance policy on various criteria: is a temporary contract whereas life insurance policy is a long-lasting contract. In the case of life insurance policy, the benefits and the sum assured is paid on the maturation of the plan or in the event of the plan holder's death.

They are nevertheless not mandatory to have. The general insurance coverage cover that is obligatory is third-party liability automobile insurance policy. This is the minimum coverage that a lorry should have before they can ply on Indian roads. Each and also every kind of general insurance coverage cover includes an aim, to supply insurance coverage for a certain facet.

Report this wiki page